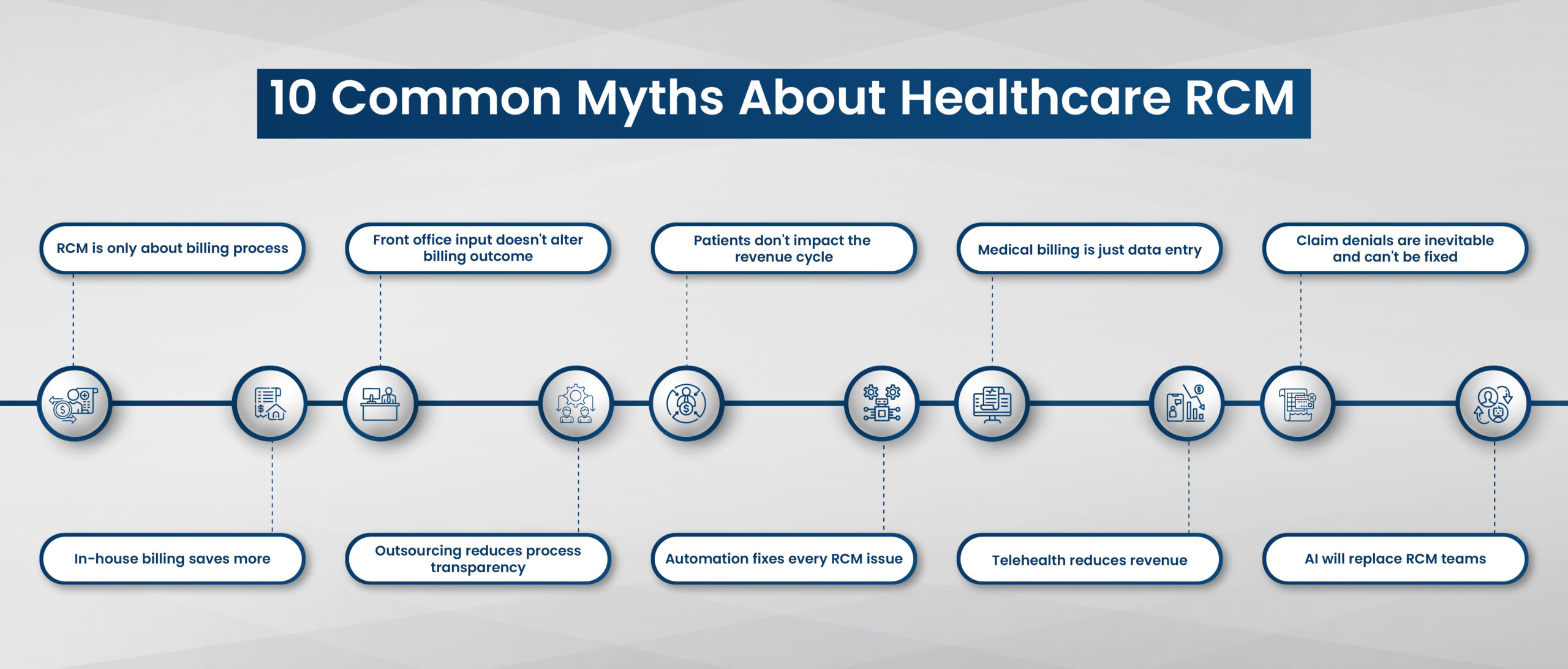

RCM myths spread like sparks in a dry forest and they’re surprisingly sticky. Even seasoned healthcare professionals fall for them because these myths often come disguised as compelling, seemingly logical explanations. The result? The same RCM misconceptions keep circulating year after year, creating costly confusion in an industry that can’t afford it.

Revenue Cycle Management (RCM) isn’t just a back-office data entry task. It is financial science for every hospital and health system to understand their operational dynamics, identify measures to improve efficiency, recognize key performance indicators, assess potential gains from adopting innovative technologies, and develop strategies to overcome barriers. Yet, outdated assumptions and myths about RCM hold many organizations back, causing costly errors and missed opportunities for innovation.

In reality, RCM experts bridges the clinical care teams and operational staff, directly influencing provider payments and patient experience. In this article, we’ll debunk the ten common misconceptions about revenue cycle management, backed by factual data and firsthand insights from providers of all sizes.

We’re here to clear the confusion and get your revenue cycle working based on facts not fiction.

Myth 1: RCM is only about billing process

Truth: RCM covers the complete financial journey of the patient.

The operation starts at the very first patient touchpoint, when a patient calls to schedule an appointment. It then extends to patient registration, benefits eligibility, prior authorizations, price transparency, coding accuracy, charge capture, claim generation, billing, payment posting, denial management, appeals, patient collection and financial analytics—all before and after the billing stage. Healthcare RCM is a strategic, organization-wide process that shapes both clinical workflow and financial outcomes.

Myth 2: Front office input doesn’t alter billing outcome

Truth: Early-stage RCM errors drives downstream denials.

Surprisingly, front-end processes like patient registration and insurance checks are responsible for over 50% of claim denials, highlighting a critical gap in early-stage process. Discrepancies in demographic data such as patient name, age, or identification number are a common cause of denials, stemming from data mismatches.

Myth 3: Patients don’t impact the revenue cycle

Truth: Patients are not passive participants; their involvement is indispensable to a healthy revenue cycle.

From providing accurate personal and insurance information during registration to timely payments of co-pays, deductibles, and balances, patient engagement directly affects cash flow. Inaccurate or incomplete patient data can lead to claim denials or delays. Furthermore, clear communication with patients about financial responsibility and available payment options reduces bad debt and increases collections.

Myth 4: Medical billing is just data entry

Truth: Medical billing requires deep truth of coding standards, insurance policies, regulatory compliance, and payer-specific requirements.

Accurate coding ensures that services are billed correctly and reimbursed fairly. Billers must interpret clinical documentation, apply complex billing rules, and stay updated on constantly evolving regulations such as HIPAA and ICD-10. They also analyze data to identify patterns and optimize revenue capture. In short, medical billing is a specialized skill set combining administrative precision with healthcare and financial expertise.

Myth 5: Claim denials are inevitable and can’t be fixed

Truth: While claim denials are common and fixable through corrective actions, most denials result from identifiable issues such as coding errors, missing documentation, eligibility problems, or billing inaccuracies.

By implementing thorough front-end checks, educating staff, and using robust claim scrubbing technology, many denials can be prevented. Tracking denial reasons and collaborating closely with payers further reduces future denials. So, claim denials should be viewed as an opportunity to enhance revenue cycle efficiency rather than an unavoidable burden.

Myth 6: In-house billing saves more

Truth: While in-house billing might seem cost-effective, it often underestimates the true costs and risks involved.

Staffing, training, software updates, compliance monitoring, and technology infrastructure require significant ongoing investment. In-house teams may lack the specialized expertise or unable to upskill for handling complex billing, denials, and payer relations. This can lead to slower reimbursements, higher denial rates, and lost revenue opportunities. Many healthcare organizations find that outsourcing billing improves financial performance, challenging the notion that in-house billing always saves money.

Myth 7: Outsourcing reduces process transparency

Truth: In fact, outsourcing to experts can enhance RCM when done with the right partner.

Leading RCM vendors provide real-time reporting dashboards, analytics, and regular updates that offer complete visibility into claims, denials, patient payments, and overall financial performance. They adhere to stringent compliance and data security standards like PHI and HIPAA to protect sensitive information. Transparent communication and clearly defined service level agreements (SLAs) foster trust and accountability. Rather than losing control, healthcare organizations gain detailed insights and performance metrics, enabling more informed decision-making and improved financial outcomes.

Myth 8: Automation fixes every RCM issue

Truth: Automation enhances efficiency and accuracy when integrated thoughtfully into an overall strategic revenue cycle process.

Automation is a powerful tool that streamlines many revenue cycle tasks, from eligibility verification to claim submission and payment posting. However, it is not a silver bullet that solves every RCM challenge. Complex situations like medical necessity denials, appeals, patient financial counseling, and nuanced payer interactions require human expertise and judgment. Overreliance on automation without adequate oversight can propagate errors or fail to adapt to changing regulations and payer policies.

Myth 9: Telehealth reduces revenue

Truth: Telehealth can actually enhance revenue when integrated strategically within the revenue cycle.

It expands access to care, increases patient volume, and improves patient retention. Many payers now reimburse telehealth services at parity with in-person visits, especially after regulatory changes spurred by the pandemic. Proper coding, documentation, and billing practices ensure full reimbursement for telehealth encounters. Additionally, telehealth reduces overhead costs related to physical facilities. When combined with effective patient scheduling, eligibility verification, and follow-up processes, telehealth becomes a complementary revenue source rather than a revenue drain.

Myth 10: AI will replace RCM teams

Truth: AI serves as an augmentative tool that empowers RCM professionals to work more efficiently and accurately.

It is not poised to replace human teams entirely. The revenue cycle requires nuanced understanding, empathy in patient interactions, clinical judgment, and complex problem-solving skills that AI cannot fully replicate. By handling repetitive tasks and providing actionable insights, AI frees staff to focus on high-value activities like denial management, appeals, and patient financial counseling. Successful organizations view AI as a collaborator blending technology with human expertise for optimal outcomes.

Breaking free from RCM myths

Shedding these 10 common yet outdated beliefs fosters a culture of continuous improvement and RCM innovation. Also, encourage healthcare leaders to embrace data-driven practices and technology agnostics that enhance adaptability in an ever-evolving industry.

At HBS, we help you uncover the underlying truths and build scalable operations with secure workflows and strengthens organizational resilience against market volatility. Letting go of these old beliefs and fears that accompany them — can empower your practice to make bold strategic decisions that transform your healthcare system. By embracing transparency, leveraging automation judiciously, recognizing the indispensable role of human expertise, and outsourcing to medical billing experts, organizations can transcend outdated paradigms and optimize revenue integrity.

If you’re ready to replace uncertainty with clarity, HBS can help you lead the way to stronger revenue integrity and long-term financial success.

Contact: +1 (818)-853-8889 | info@hamlybusinesssolutions.com